The Buffett Blueprint: How to Build Wealth From Zero

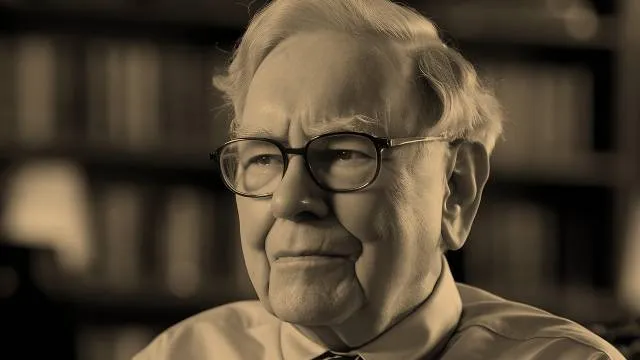

The Oracle of Omaha mapped out exactly what he’d do to get rich if he had to start over from scratch — a strategy we’ve dubbed The Buffett Blueprint.

Importantly, this isn’t an interpretation of his words or speculation over what he’d probably do; Instead, these are Buffett’s own words, fully sourced and straight from the Oracle himself.

Warren Buffett has amassed one of the largest fortunes in history, but what if he had to start over again? This exact question has actually been asked of him multiple times over the years, and his answers — which were direct and detailed — provide a clear roadmap for anyone looking to build wealth from modest beginnings.

At Berkshire Hathaway’s 1999 annual meeting, Buffett confidently stated he could achieve 50% returns per year with a small amount of capital. He reaffirmed this claim in 2024, elaborating further on exactly how he’d do it.

The strategy is refreshingly straightforward, yet demands uncommon discipline and passion.

Here it is — The Buffett Blueprint.

The Small-Scale Advantage

Buffett’s strategy begins with a fundamental insight: small investors possess advantages that disappear at scale.

“I think I can name a half a dozen people that could earn fifty percent a year on a million dollars,” Buffett explained at the 1999 Berkshire meeting. “Those people could not compound $100,000,000 or a billion, at anything remotely like that rate.”

This size advantage is crucial: “Working with a very small sum, there is an opportunity to earn very high returns, but that advantage disappears very rapidly as the money compounds,” says Buffett.

The reason is simple: truly attractive opportunities are often too small for billionaires to pursue. As Buffett explains: “You find very very small things that you’re almost certain to make high returns on, but you don’t find very big things in that category today.”

Methodical Research of Small Securities

Buffett’s approach generally focuses on exhaustive research of small, overlooked companies.

“I would try and know everything about everything ‘small,’” Buffett said at the 2024 meeting. His method? “Going through the 20,000 pages,” meaning you should go all-in and absorb any and all available information in your chosen area — multiple times.

This isn’t hyperbole. In his youth, Buffett literally read comprehensive financial manuals cover to cover. “I went through the Moody Transportation manual a couple of times — that was 1,500 or 2,000 pages — and I found all kinds of interesting things when I was 20 or 21.”

He recommends starting systematically: “start with ‘A’ and go through [to ‘Z’] and you just look at everything, and you find small securities in your area of competence that you can understand the business.”

This approach led him to discover oddities like the Green Bay and Western railroad, which had “a bond that was actually the common stock, and a common stock that was actually a bond” — the kind of structural quirk that creates profit opportunities for those paying attention.

Finding Inefficiencies and Arbitrage

Beyond merely identifying undervalued businesses, Buffett specifically mentions seeking out market anomalies.

He would look for “little arbitrage situations or little wrinkles here and there in the market” that offer near-certain returns. These opportunities exist because large institutional investors can’t focus on them — they’re simply too small to move the needle for a multi-billion dollar fund.

The Circle of Competence Is Non-Negotiable

Buffett repeatedly emphasizes the importance of staying within your circle of competence.

“Find small securities in your area of competence that you can understand the business,” he stresses. Without this understanding, even attractive prices aren’t enough to justify investment.

This focus explains why he avoids certain sectors despite their potential. When asked about technology companies, Buffett admitted: “You name ten high-tech companies to me and ask me where they’re going to be in 10 years or 10 months, and I don’t have the faintest idea.”

Full Attention and Time Commitment

Achieving 50% returns isn’t a part-time endeavor. Buffett is clear that investors pursuing this strategy “would have to have their full attention working on this.”

The work demands complete dedication — likely incompatible with other full-time pursuits. The level of research required to find these opportunities cannot be accomplished casually or sporadically.

Passion Is Prerequisite

Perhaps most importantly, Buffett insists that success requires genuine enthusiasm for the process itself.

“You have to be in love with the subject — you can’t just be in love with the money,” he explained at the 2024 Berkshire meeting. Success comes through passionate interest, similar to how people excel in other fields: “A biologist looks for something because they’re driven to look for it and it’s built in.”

Buffett compares successful investors to “great bridge players” and “great chess players” who become experts through their love of the game. “You can’t do it if you don’t find the game of interest,” he warns.

This intellectual curiosity must drive the hundreds of hours needed to develop expertise: “You find out what your brain is really suited for, and then you just pound the hell out of it from that point.”

Historical Evidence: The Washington Post Example

Buffett’s approach is perfectly illustrated by his 1973 purchase of Washington Post Company shares.

“In the mid-70s, the whole Washington Post company was selling for $80 million at the time when the properties were worth not less than $400 million,” Buffett recalls in an interview with Adam Smith. “The price was there for all to see, but people just didn’t feel very enthusiastic about the world then.”

That $9.7 million investment later grew to $370 million — a return possible only when buying significantly undervalued businesses with a substantial margin of safety.

Similar successes came with Capital Cities (growing from $517 million to $927 million) and Geico (turning $46 million into $849 million).

The Right Temperament

Beyond strategy, Buffett emphasizes developing the correct mindset. He suggests a thought experiment: if your stock drops 10% and you’re upset, “it obviously means that you think the market knows more about the company than you do.”

The right response? “If it goes down 10 and you want to buy more because you know the business is worth just as much as when you bought it before…then there the patsy is someone else.”

This emotional stability — the ability to ignore market fluctuations and focus on business fundamentals — separates successful investors from the crowd. As Buffett puts it: “If the stock exchange closes for a couple of years and the business does well, we’ll do very well.”

Today’s Challenges

Buffett’s longtime business partner Charlie Munger acknowledged that what worked decades ago has become more difficult.

“We had it very easy compared to you,” Munger told a shareholder in 1999. “It can still be done, but it’s harder now. You have to know more.”

Simply “sifting through the manuals until you find something that’s selling at two times earnings — that won’t work for you.” Buffett added humorously, “It’ll work — you just won’t find any.”

Despite these challenges, Buffett maintains (even in 2024) his approach remains viable for those willing to commit fully.

The Patience Factor

Buffett’s blueprint demands qualities increasingly rare in modern investing: patience, thorough research, and independent thinking.

“It requires patience which a lot of people don’t have,” Buffett explained. People “would much rather be promised that they’re going to win a lottery ticket next week than that they’re going to get rich slowly.”

He contrasts his long-term orientation with common market behavior: “Gus Levy used to say that he was long-term greedy, not short-term greedy. If you’re short-term greedy, you probably won’t get a very good long-term result.”

The Buffett Blueprint:

Buffett’s formula for starting over combines several essential elements:

- Focus on small, overlooked opportunities within your circle of competence — and nothing else

- Conduct intense, exhaustive research with genuine passion and full attention: know absolutely everything in your circle of competence

- Be alert and hunt for oddities and anomalies — things like market inefficiencies and arbitrage opportunities

- Maintain emotional discipline regardless of market movements: rely on your own analyses, not market prices

- Be patient; have a long-term view; and allow compound interest to work its magic over time

While today’s market presents greater challenges than when Buffett began, his message remains clear: spectacular investing results are still possible for those starting with modest sums — if you’re willing to do the work others won’t, and if you genuinely love the process itself.

The Buffett Blueprint isn’t a shortcut to wealth — it’s a demanding path that requires intelligence, discipline, and genuine enthusiasm. But for those willing to follow it, Buffett’s own track record suggests the potential rewards are extraordinary.

This article accurately represents the views of Warren Buffett and is being made available for educational purposes only, and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Blockchainsure believes that the sources from which such information has been obtained are reliable; however, Blockchainsure cannot guarantee the accuracy of such information.