TLDR: Central Bank Digital Currencies (CBDC)

Central banks worldwide are creating their own digital currencies (CBDCs) that work like regular money but in digital form. There are two types: one for everyday people to use (like digital cash) and another for banks. While CBDCs could make payments faster and cheaper, there are challenges to solve first - like making them secure, ensuring everyone can use them, and creating the right rules. Some countries like China and the Bahamas are already testing them, and they’re likely to become more common in the future. Don’t worry though - regular cash isn’t going away anytime soon.

CBDCs: How Central Banks Are Planning to Transform Money

Imagine pulling out your phone to buy a coffee, but instead of using your regular banking app, you’re spending digital money straight from your country’s central bank. Sound futuristic? Well, it’s already happening in some parts of the world, and it might be coming to your country soon.

Welcome to the world of Central Bank Digital Currencies - CBDCs for short. With the growing popularity of cryptocurrencies like Bitcoin, governments are now considering crypto-like digital versions of their national currency. And they have the potential to change how we all use money.

What’s the Big Deal?

To be clear, we already use digital money. You can already spend and receive money digitally, over the internet. But CBDCs are a bit different. Instead of being guaranteed by a bank or financial company, a CBDC is guaranteed by a government. That means they would be faster to use, harder to lose, and could make it easier for everyone to have access to banking services. Plus, CBDCs could make sending money to other countries as easy as sending a text message.

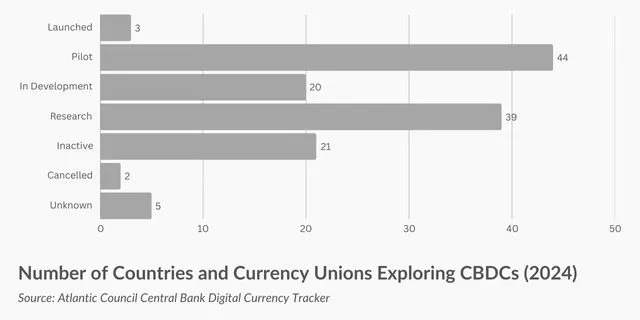

Right now, several countries are testing these digital currencies. China is leading the pack with its digital yuan, which millions of people are already using. The Bahamas has the “Sand Dollar,” and even Sweden is working on something called the “e-Krona.”

Two Flavors of Digital Money

CBDCs come in two main types:

Retail CBDCs

These are for regular people like you and me. They’re designed to be as easy to use as cash but in digital form. You could use them to buy groceries, pay rent, or send money to friends.

Wholesale CBDCs

These are for banks and big financial institutions. Think of them as the behind-the-scenes money that keeps the financial system running smoothly.

The Tricky Parts

Creating digital money isn’t as simple as it might sound. Here are the big challenges that central banks are trying to figure out:

Safety First

Just like your social media accounts need strong passwords, digital money needs serious security. Central banks are working extra hard to make sure hackers can’t steal this new form of money.

Making Sure Everyone Can Use It

Not everyone is comfortable with digital technology. Banks need to make sure older people, people without smartphones, and those who prefer cash aren’t left behind.

Getting the Rules Right

Countries need new laws to make sure digital money works properly and fairly. It’s like creating traffic rules for a new kind of vehicle.

Playing Nice with Regular Money

Digital currency needs to work smoothly with the regular money and banking systems we already have. It’s like adding a new player to a team – they need to fit in with everyone else.

Real-World Examples

Some countries are already showing us how CBDCs might work:

- China: Their digital yuan is the world’s biggest CBDC project. Millions of people are using it to shop, pay bills, and send money to each other.

- Bahamas: The Sand Dollar helps people on remote islands do banking without needing to travel to a physical bank.

- Cambodia: Their Bakong system is making it easier for people who never had bank accounts to save and spend money digitally.

What’s Next?

The future of CBDCs looks exciting. Here’s what we might see:

- Sending money to other countries could become as quick and cheap as sending an email

- New ways to pay that we haven’t even thought of yet

- Better financial services for people who currently don’t have bank accounts

- More cooperation between different countries’ digital currencies

What It Means for You

While CBDCs might sound complicated, they could make your life easier in many ways:

- Faster payments

- Lower fees for sending money

- No more worrying about losing cash

- Easier online shopping

- Quick government payments (like tax refunds)

But don’t worry – most countries plan to keep regular cash around too. The goal isn’t to force everyone to use digital money, but to give people more choices in how they pay.

The Bottom Line

CBDCs are coming, and they’re going to change how we think about money. While there are still challenges to solve, central banks around the world are working hard to make digital currencies safe, easy to use, and helpful for everyone. The future of money might be digital, but it’s being built to work for all of us.

Blockchainsure stands by the pursuit of truth, and each article we publish draws on reliable sources and scientific principles. We are resolutely committed to accuracy and integrity. If you have any questions or notice errors, please reach out through our contact page.